Business loans provide quick cash support in line with goals for growth or continuing demands of the company. Entrepreneurs and startup owners may be eligible for a business loan of up to £100,000 without the need for collateral, depending on the lender’s policies. There is little documentation required and an efficient application process. Through the website or mobile application of a trustworthy lender, potential borrowers can easily submit an online application. Upon completion of the smooth process, the lender quickly deposits the loan amount into the borrower’s bank account. It is essential to fulfill the eligibility requirements set forth by the lender.

Normally, funds are disbursed 72 hours after the lender gives final clearance.

How do I launch the application?

- Go to the website of the lender.

Step 2: Select “Apply Now.”

- From the list of alternatives, select “Business Loan”.

- Enter the amount you want to borrow.

- Indicate if you work for yourself or are employed by a company.

- Provide personal information such your name, phone number, and birthdate.

- Mention your city and annual revenue.

- Send in the application.

The lender swiftly notifies you of your eligibility after receiving your submission. After your eligibility has been successfully verified, a customer service agent will get in touch with you to explain plans that are specifically tailored to your need and to continue with your application.

Use a free online business loan eligibility calculator to find out if you qualify for a business loan in advance and to find out the maximum amount you may borrow. This will speed up the application process.

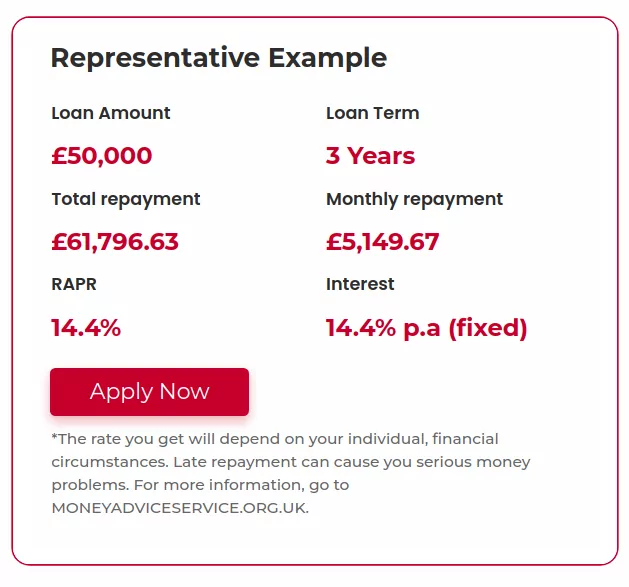

Sample of Loan Calculator (don’t click).