Apply For A Fast Expansion Loan

Unlock Your Business’s Potential with Our Expansion Loans!

Take your business to new heights with the capital you need to expand operations, reach new markets, and increase profitability.

Grow confidently with tailored financing solutions designed to fuel your success.

Small firms may get financing by taking out small business loans. The lender in this situation is typically a government agency, a corporation, or a financial institution that advances the borrower’s money. The borrower is provided with the funds subject to several stipulations, including finance charges, interest, and payback terms. Small company loans often have a predetermined term during which you must pay back both the principal and interest.

To assist you with your financial needs, loan proposals from reputable British lenders will be provided.

Your loan application will pass through three easy and fast steps:

- You set the loan amount, for how long you require the loan, the scope of the loan, and a little info about your company.

- Our lending specialists will inquire about the market and locate the finest loans for you.

- There’s a very good chance you might get your money within a few hours once your application is approved by the system.

Our knowledgeable team is extremely familiar with the UK small business financing industry.

To connect you with the best lender, we pay attention to your demands and research the market for you.

You may think of us as your partner who is navigating through the options and helping you obtain the funding you require when you need quick and affordable access to a small business loan.

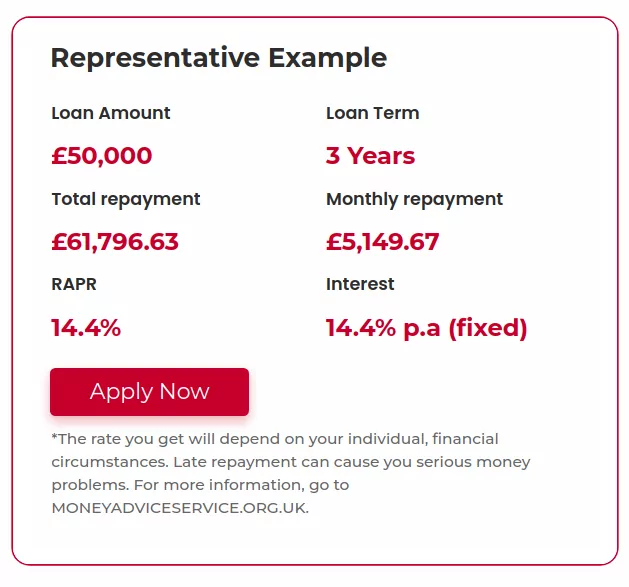

Here is a sample of an SME loan application output from our system

Apply For A Fast Expansion Loan

Types of Loans

Unsecured loans

Unsecured loans are frequently quick and simple to arrange. Your assets are typically not at risk if you default because you are not required to pledge any of them as security. With unsecured credit, you do, however, incur a higher interest rate. Additionally, because of the increased risk for the lender, the amount you can borrow is reduced.

Secured loans

When you apply for a secured loan, the lender will require collateral, which is frequently larger assets like real estate. As opposed to an unsecured loan, you can typically borrow more money at a cheaper interest rate. However, your collateral is in jeopardy if you have difficulties making your payments.

Business Credit lines

You can use as much or as little as you need and just pay interest on what you borrow if you have a personal overdraft, so you know that. The same is true for company credit lines, giving you peace of mind knowing you have money available if you need it.

Flexible loans

With a flexible loan, your company has some control over the repayment plan, allowing you to customize it to your needs. This implies that you could make a larger repayment one month, a smaller repayment the following, or even skip a payment.

Why apply for a loan

- Make technology upgrades

- If you feel like your firm is lagging, you can use the extra funds to upgrade your technology, redesign your website, upgrade your machinery, etc.

- Improve your premises

- Buy more stock

- Run more efficient marketing campaigns

- Increase your cash flow and cover unexpected future money shortages

Terms

Restricted sectors

- Gambling

- Alcohol

- Adult entertainment

- Forex trading business

- Munition/Weapons

Minimum Requirements

- Business registered for – minimum 1 year

- Annual Turnover – £100k minimum

- Loan requirement – min. £10k